Shared by/by Yamila Torres

Since last March, an updated table has entered into force with the income that a sponsor of the new parole must contribute to emigrate to the United States.

As is known, those who wish to act as sponsors or support persons in the US for potential parole beneficiaries must submit an “Affidavit of Economic Support.”

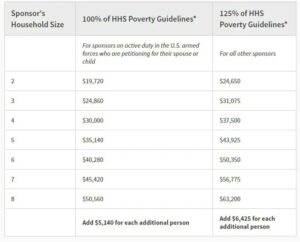

The US Citizenship and Immigration Service (USCIS) uses the Department of Health and Human Services (HHS) Poverty Guidelines to determine the sponsor’s ability to support the beneficiary during their stay in the country.

“The law requires that the sponsor demonstrate an income level of at least 125 percent above the federal poverty level. If your income does not meet the requirements, your financial capacity could be determined based on other assets, such as checking and savings accounts, stocks, bonds or properties,” the immigration authority specifies on its official website.

Banking woes send consumers looking for safer alternatives

Suzanne Potter

California News Service

The recent collapse of Silicon Valley Bank and Signature Bank has put a spotlight on the safety and stability of the U.S. financial system. Now, some experts are pointing to a greater role for community banks.

Nuray Ozbay, investment officer for Self Help Federal Credit Union in California, said Community Development Financial Institutions and Minority Depository Institutions, known as CDFIs and MDIs, are comparatively well-capitalized, and with high levels of liquidity.

“Community banks, CDFIs and MDIs are usually financially conservative,” Ozbay explained. “They put their members first, and they are usually risk-averse. So, they are safe places to invest.”

Silicon Valley Bank focused heavily on startups while Signature Bank had a lot of money tied up in cryptocurrency. Ozbay noted local banks are much less likely to rely on such higher-risk investments.

Brady Quirk-Garvan, co-owner and financial adviser for Natural Investments, which helps people invest their money according to their values, said smaller credit unions are more accountable to their members, because the members are also the banks’ main investors.

“They’re more likely to take profits from the year and invest it in member services,” Quirk-Garvan pointed out. “Whether that’s hiring more tellers, or whether it’s investing by making loans in a local community bakery, they’re making a different set of decisions when it comes to their values.”

The Federal Deposit Insurance Corporation, the FDIC, keeps the banking system stable by insuring all deposits up to $250,000, no matter the size of your bank.